FREE GUIDE

Get your copy of the ultimate guide to lead generation through telecalling (scripts included)

Have you ever wondered how many customers you lose every year? Or perhaps monthly?

This is where customer churn rates come in. Churn rates can help you understand exactly how your business is doing. Moreover, they allow you to know what your current customer turnover is.

It’s important to know how many customers your business is losing. Without this, you won’t be able to know about its impact on your business. As such, it will be difficult to devise plans and strategies to reduce turnover.

Although it sounds a bit scary, churn rate is quite a necessary metric. However, at times it can be difficult to calculate as well as deal with customer churn.

No need to worry. In this article, you will learn about about churn rate, what it is, how to calculate it and more.

Churn rate refers to the rate at which customers discontinue doing business with a company.

Maintaining a low churn rate can prove highly beneficial for a company. It allows you to grow and increase profits with minimum interruptions in your work processes.

In a subscription-based service, churn rate would account for how many customers choose not to renew their subscription. This icludes both before and after the subscription expires.

The rate applies to your customers who switch to another service and those who terminate their service without switching.

There are two main types of churn – voluntary or active churn and involuntary or passive churn.

Both types of churn result in a loss of your customers as well as revenue. However, their underlying factors and prevention measures are very different.

Voluntary churn occurs as a result of your customers actively terminating their own subscription. Owners of businesses tend to focus on churn of this kind.

This is because these customers make a conscious decision to leave behind your business.

There are often many reasons behind your customers’ decisions to leave. Some common ones are:

In order to prevent and decrease voluntary churn, you need to focus on your customer-brand relationship. It’s important to have a very good understanding of your customers’ opinions and feelings toward your products.

Make your product along with customer service invaluable. Ensure to provide frequent value they are unable to live without. These are tried and tested ways to reduce revenue loss as a result of voluntary churn.

Involuntary churn occurs when a business chooses to stop providing services to customers because they’re not paying. When your customer’s payment attempt doesn’t go through, without them realising it, it ends in the cancellation of subscription.

There are often many reasons behind businesses discontinuing service to customers. Some common ones are:

Oftentimes, companies optimise their checkout pages in order to prevent involuntary churn.

In addition to this, they employ smart follow-up and collection strategies. They allow them to better communicate with customers and recover payments.

Calculating churn rate can be quite simple really.

When calculating churn rate, you need to pick a time frame, like annually or monthly. Then, you must determine the total no. of customers at the beginning of the time frame. Figure out the total number of lost customers as well.

Afterwards, you will have to divide the following:

Total no. of lost customers ÷ Total no. of customers at the beginning. Then, you have to multiply the answer by 100.

For example, let us say that your company had 800 customers at the start of last quarter.

Unfortunately, you lost 100 customers because of poor customer service along with expired contracts.

[ Image Requirement: Visual of the churn rate formula ‘(Total no. of lost customers ÷ Total no. of customers at the beginning) x 100’ ]

This would make your quarter’s customer churn rate 100 churned customers divided by 800 former total customers. As such, 100 divided by 800 is 0.125.

Multiplying this number by 100, you would get a customer churn rate of 12.5%.

Here’s how your mathematical calculation would look:

Customer Churn Rate = (100 ÷ 800) × 100

Customer Churn Rate = (0.125) × 100

Customer Churn Rate = 12.5%

Churn rate is a very important metric that should be monitored by any subscription-based business. It helps you understand the long term stability of your business as well as forecast growth.

A high churn rate could negatively impact your profits and impede growth. Thus, churn rate is a highly important factor in the telecommunications industry.

In most areas, many of these companies have stiff competition. This makes it easy for customers to shift from one to another.

Not only does churn include when customers switch carriers, it also includes when they terminate service without switching. Hence, this information can prove highly useful for subscriber-based companies, wherein subscription fees make up most of the revenue.

Good churn rate depends on the size of the company as well as the industry in which it operates. Normally, the lower the churn rate is, the better it is for the business.

Small businesses commonly consider 5% per month to be a good churn rate. Meanwhile, larger companies aim for a much lower churn rate.

If there’s a lot of competition present in a certain industry, this could lead to higher churn rate. This is due to many more options being easily available.

Churn rate and retention rate are two metrics that businesses use to help them earn and retain customers.

Both of them are very useful in getting to know more about customer satisfaction in your business. They also help you learn more about how to maintain and improve it.

If you want to build your customer base, learning about churn and retention rates is extremely helpful.

You’ve already learnt about what churn rate is as well as how you can calculate it. Now, let’s take a brief look at retention rate.

Customer retention rate refers to the extent to which a business keeps its existing customers. Basically, it helps your business ensure your marketing strategies and efforts to maintain customer satisfaction are effective.

Higher retention rate would also mean that your company can spend less time searching for new customers. Thus, improving cost-effectiveness.

Furthermore, it can also lead to increased profits. This is because customers are more likely to spend more on a service they trust.

To calculate retention rate, you need three pieces of information. Firstly, you should know how many customers you had at the beginning of a time period. Secondly, how many there were at the end and exactly how many new customers signed up during the period.

Then, you have to subtract the number of new customers from your total at the end of the period. Next, divide that number by how many customers you started with. Finally, multiply your answer by 100.

For example, say you started the year with 50,000 customers. You then added 5,000 new ones during and ended the year with 45,000 customers.

So, to calculate retention rate, you’d have to do the following:

Customer Retention Rate = [(50,000 – 5,000) ÷ 45000] × 100

Customer Retention Rate = [1] × 100

Customer Retention Rate = 100%

Thus, your retention rate for the year is 100%.

An ideal retention rate is one that is as close to 100% as possible. This means that the business is keeping almost all of its customers satisfied.

Similarly to churn rate, good retention rate would vary based on size of business and the industry. Moreover, it can also depend on the age of your company.

A company that is more well-established may have higher retention rates. This is due to your service being well-known and customers understand what to expect from it.

In comparison, a younger company might have lower rates. This happens as customers are still currently testing and learning more about your service.

The main distinction between is that churn rate calculates the percentage of customers lost by a business. Meanwhile, the retention rate calculates the percentage of your customers kept/retained.

In both of the cases, businesses aim to be close to one extreme. For example, 0% for churn and 100% for retention.

However, the way businesses interpret these rates is different. A high churn rate is considered bad while a high retention rate is considered good.

Overall, both rates reflect levels of your customer satisfaction. Furthermore, they both help businesses understand what they’re doing well and which strategies they can improve.

As you now know, churn rate measures the customers lost by a company in a given period of time.

If you want your company to grow, it’s quite simple. Just ensure that the number of new customers is higher than customers lost in a given period of time.

Remember to keep in mind that every industry will have a different average churn rate. You can then compare your own with these to better understand their competitiveness.

Hence, you too need to calculate and keep a close eye on your churn. This will ensure that it’s properly under control and that your business thrives.

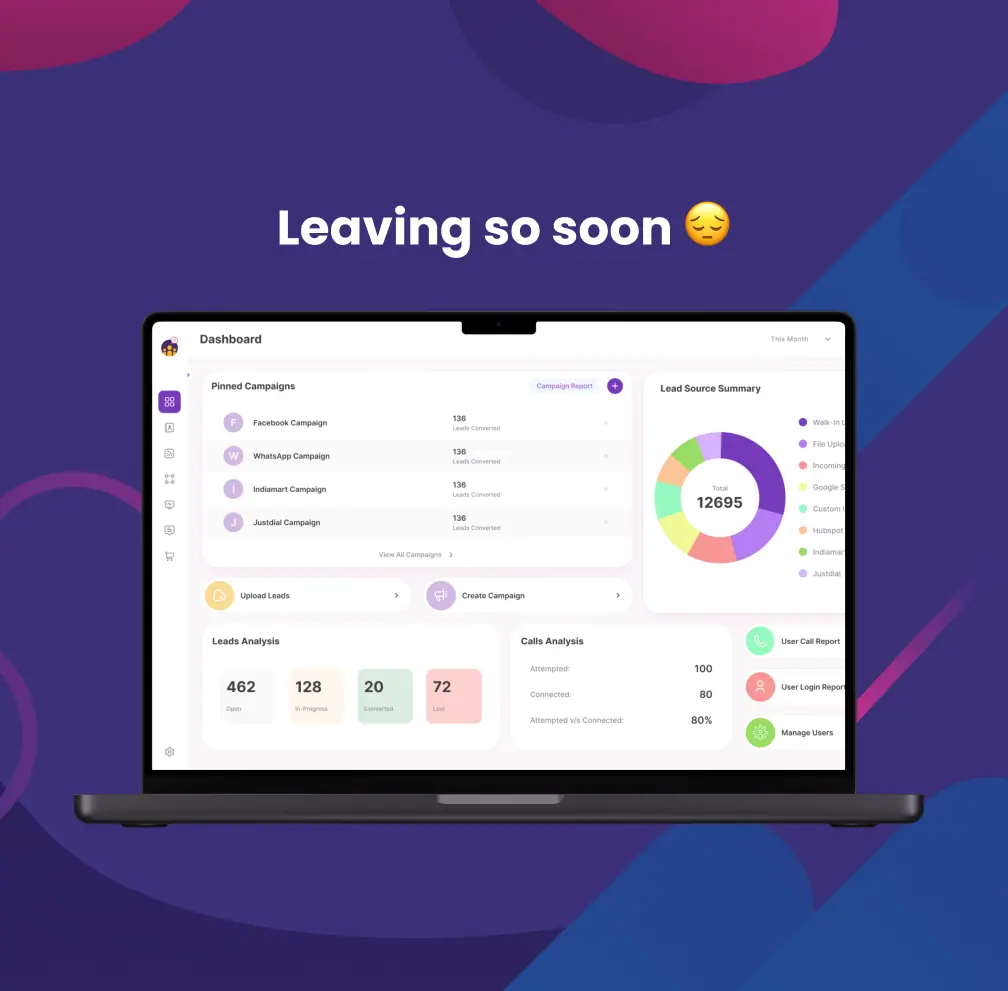

95% business who use NeoDove report 3x more profits!

Happy Customers

107k reviews

These outcomes and beyond can be yours.

Lead Leakage

Increase in call attempts

More Engagement

FREE GUIDE

Get your copy of the ultimate guide to lead generation through telecalling (scripts included)